Consumers share struggle to replace ring if lost, damaged

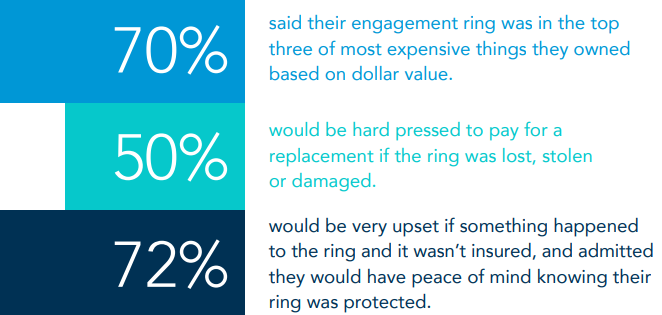

In a new study from Jewelers Mutual Group, they found that over 70% of consumers surveyed said their engagement ring was one of the most expensive things they owned. Nearly half of respondents shared they would be hard-pressed to pay for a replacement if the ring was lost, stolen or damaged.

“The engagement ring is up there with a house or vehicle in terms of major investments,” said Bryan Howard, Jewelers Mutual’s director of product management. “Unlike a house or vehicle, engagement rings (and other jewelry) are one of the smallest, most likely items to become lost. That's why insuring jewelry that has both financial and sentimental value is so important."

Of the consumers surveyed, 72% said they would be very upset if something happened to the ring and it wasn’t insured, and admitted they would have peace of mind knowing their ring was protected.

View the infographic for more results from the study.

According to Jewelers Mutual, mysterious disappearance (or unexplained loss) is the most common reason customers file a claim. It’s also a coverage not always included in a typical homeowners or renters policy, unlike a specialized jewelry insurance policy.

“Unfortunately, people often don’t think about whether they have the right coverage until it’s too late,” Howard said. “We strongly encourage folks to evaluate their options on how to protect such a significant investment as an engagement ring. With the right protection, you can feel confident that if your ring is lost, stolen or damaged, you won't have to reinvest with funds from your own pocket to repair or replace it."

If you are wondering whether your engagement ring or other jewelry is worth insuring, Jewelers Mutual recommends asking yourself these questions:

- Would I be devastated by the loss of my ring?

- Are there coverage limits with my current insurance?

- Would I be able to comfortably cover the cost of a replacement?

If you answered yes to any of these questions, a standalone jewelry insurance policy is worth consideration. For more information, visit JewelersMutual.com.

Source: Personal Lines Trigger Study. Jewelers Mutual Group and Market Research & Insights. January 2021.